By Sam DeBord

When talking to associates and the public about real estate topics, it’s important to be educated on the issues that we value most as REALTORS®. Government fiscal and tax policy can be confusing issues that many REALTORS® don’t feel they have time for. Still, anyone working in the industry is bound to strike up a conversation that leads to the current budget shortfall and potential ways to fix it. Reducing or eliminating the Mortgage Interest Deduction is often suggested.

REALTOR® advocates need to know a few quick facts to show our clients and our communities why this deduction is so important to homeowners, families, and the country as a whole. This infographic makes the major points that every REALTOR® should be able to recount, without getting mired in the muck of too much tax policy:

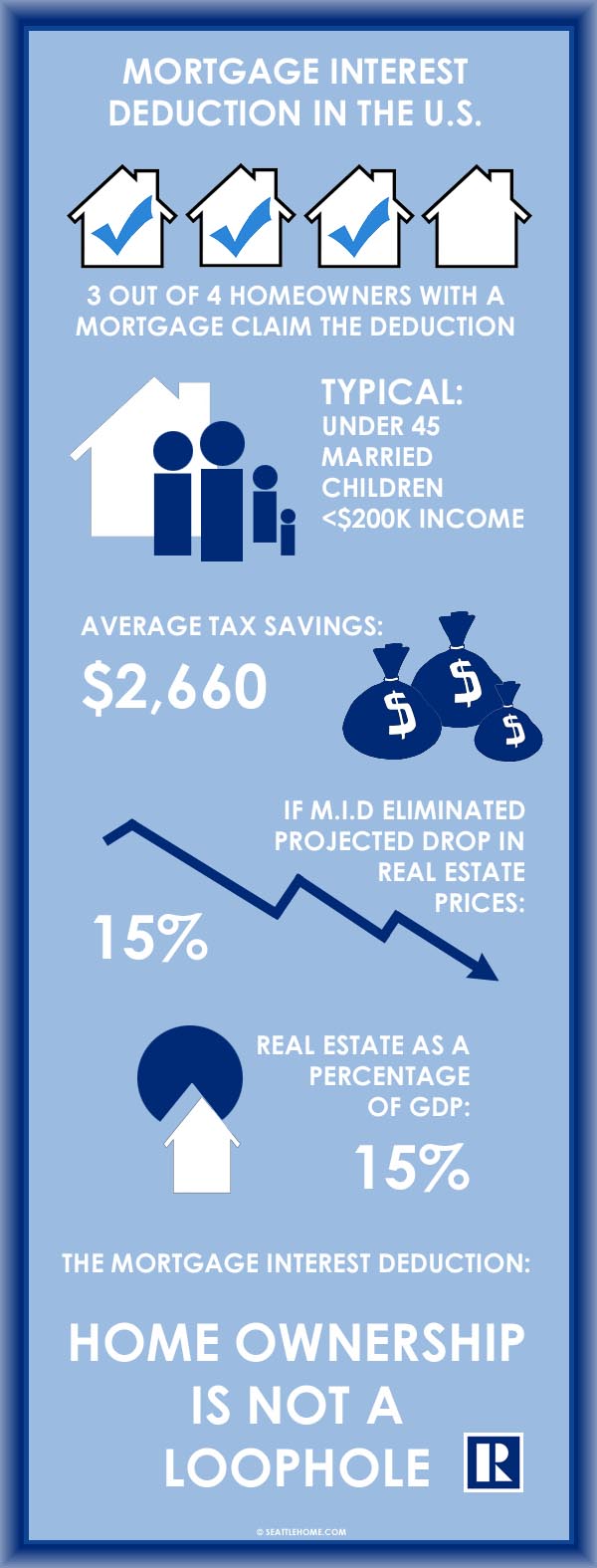

The statistics make it plainly clear how valuable the Mortgage Interest Deduction is to Americans. Roughly three out of every four homeowners with a mortgage claims the deduction.

With an average tax deduction of $2,713, the MID is a major savings for home buyers who are investing in their futures. Without that deduction, we’d see some significant increases in taxes for middle-class Americans.

The typical taxpayer who claims the MID is under 45 years old, married, and has children. Their household income is under $200,000. This is the quintessential working family that is in the process of building a nest egg for their children’s future and long-term for retirement. Saving those tax dollars each year is encouraging them to make investments in their community.

One of the biggest concerns with proposals to change the MID would be the effect on home prices. Values of real estate across the country would be projected to fall 15 percent if the MID were eliminated altogether. After finally beginning to recover from the previous downturn, real estate markets would be devastated by another such a drastic drop in prices.

Real estate is one of the biggest components of the national GDP, comprising about 15 percent of the total. Consumer spending creates jobs and economic growth, and real estate has always been a leading driver for consumer spending. Our national economic well being is, and always has been, tied to a healthy real estate market.

As REALTORS®, we’re obligated to speak up when real estate issues are on the table. We know better than anyone the importance that the real estate market plays in every American’s financial well-being, whether or not they own a home. Political arguments may espouse some lofty theories, but the real-world facts support our position.

Sam DeBord is a State Director for Washington REALTORS®, and managing broker with Coldwell Banker Danforth. Connect with his team at SeattleHome.com.

Comments 7

I’m highly suspect of a 15% drop in real estate prices. Prices would likely decline some but considering how many homeowners have much of their MID reduced due to the standard deduction, the impact of the loss of the MID I believe is overstated.

We say “do no harm to housing” and “home ownership is not a loophole” because it is our industry yet when other industries make similar claims about the importance of their tax incentives we call it special interests. A system-wide tax reform is needed and if we all say “hands off my stuff” then it can never happen.

Thanks for the comments, Aaron. Studies have made that 15% projection, but it’s certainly open to interpretation. Any drop in prices at a critical turnaround time like this would be bad for the economy.

Not all tax incentives are equal. If you believe that home ownership makes communities and families more stable, increases savings and investment in local neighborhoods, and creates economic growth nationwide, you can honestly state that the M.I.D. is more important than other tax incentives.

Well the MID actually creates disincentives to savings because it only rewards homeowners who are in debt. It also may have partially contributed to the housing downturn by making it more attractive to pull equity out of a house to spend on other things.

A homestead tax credit (versus a deduction) would provide tax benefits to all homeowners and also mean lower income owners may actually see a benefit from it.

Ask any special interest why their tax deduction is important and they will tell you all the reasons why theirs is more important than others. They will also tell you of all the problems that will happen if you even look at their deductions with a questionable eye. This is why no reform actually ever happens.

As for it being a bad time, what time is a good time to discuss it and would you discuss it then? If not, then the timing means nothing.

How we’re ever going to fix our tax code is beyond me.

These are good points, but tax policy in a vacuum. “Special interests” is a term used to discount all groups’ concerns without differentiation. Some are more worthy than others. We can have conversations about which policies we value more than others, and which incentives are better for our country than others.

We’d be happy to discuss adding a tax credit for homeowners who don’t have a mortgage. Removing the current deduction–which is a major component of current homeowners’ budgets–would be pulling the rug out from under millions. As to timing, it would never be a good time to remove the MID, but doing it during a period of recovery would be doubly hurtful to the economy.

The MID gets first-time buyers started investing instead of renting. The “disincentive to savings” is again vacuum tax theory. Nearly every first and second-time home buyer is borrowing to buy a home, and their only option is to finance. In most areas of the U.S., home prices require financing.

We agree–“fixing” the tax code in the short term isn’t likely. Dropping important, useful deductions to try to fix the current budget isn’t the way to do it. When the average recipient is a young family with moderate income, it shouldn’t be laid on their backs.

Sam,

I cannot believe that you used the “some are more worthy than others” line regarding special interests and tax deductions. Do you not think that EVERY special interest thinks that theirs is more worthy than others when it comes to tax breaks? It is exactly this mentality that breeds gridlock and a stagnant economy.

Don’t you think the alternative energy industry thinks they have a very worthy goal, to reduce dependence on fossil fuels and create renewal energy resources? But you can see what all the tax breaks to that industry have brought: chaos, bankruptcies, and high costs that make the source more dependent on tax breaks. A never ending cycle of futility.

Perhaps the conversation that we need to have should be about eliminating ALL tax breaks for ALL special interests, including churches who claim tax free status and deprive local economies of billions of dollars in property tax revenues, and corporations who can park money overseas because the current tax code is so convoluted that it encourages them to do so. If your business model is strong enough that consumers will support it, it won’t need a tax break. If not, it will not and should not survive.

I agree with Aaron. Changing our tax system is paramount, it is so broken, it needs to done over!

Government involvement in our markets has caused this terribly long recession. A reformed tax system will improve the economy.

There are a whole plate of issues, but a main item is to eliminate the influence peddling, and a constitutional amendment to reverse Citizens United v. FEC. Until that happens, consider us all manipulated by BIG money.

David and Noel,

We all agree that the tax system is convoluted, overly burdensome, and should be streamlined.

We also all know, if we’re being honest and have followed tax and political history, that it’s not going to happen.

Sometimes we have to work within the imperfect systems that surround us. We can all wish for a simple tax code that has no special interest influence. In the meantime, we have to work for the best possible solution within the framework we’ve been given. When the vote to eliminate all special interests at once comes down, it will have my vote. Since that realistically won’t happen, we’ll just keep fighting for the practical, useful deductions like the MID that actually create economic growth for our country and practical benefits for homeowners.